Boring , compounding , or is it?

Good Evening!

I got this crazy (honestly .... if i find it a bit "siao" it should be quite siao la) idea that i've delayed over a year or two. Recent events such as my mum falling ill and the recent passing of my 大舅 (Mum's eldest bro) have helped cement the notion of going through with the idea.

THE IDEA in context? A family owned company which buys shares in listed companies with no or low debt and use the dividends to be reinvested together with additional capital contribution on a yearly basis.

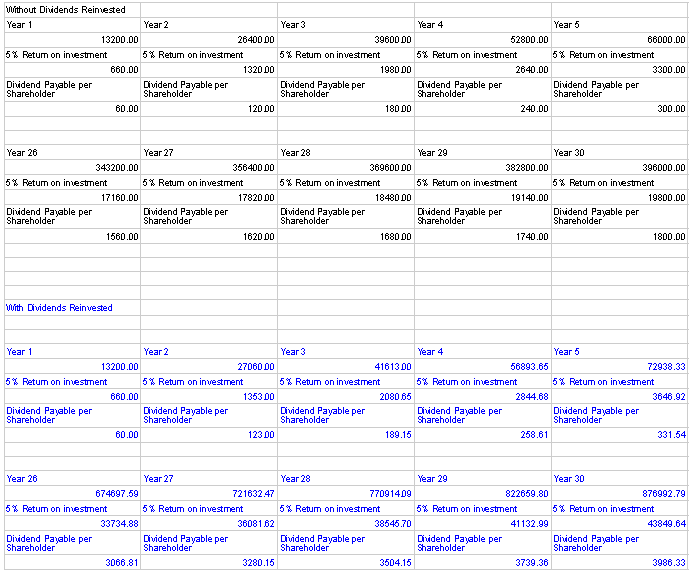

I've attached a table below for viewing. Assuming a yield of 5% P.A. from dividends , excluding capital appreciation , aga aga results are as shown below.

FYI , my extended family is big so can do it on such a scale if not each shareholder contribution has to be larger to obtain such results.

Disclaimer(s):

1) Chart too small don't blame me , zoom in , zoom zoom. Paiseh la , i IT. noob (I provided two snips which should help in understanding the table.)

2) This is based on $100 contribution per shareholder for 13Months! (Why 13 mths? Like working ma , need to have bonus! Kidding la , the 13th month contribution is for company expenses like admin fees ,brokerage fees, acra fees etc etc.)

3) This company has 11 directors so $100 x 12mths = $1200 x11 = $13,200 combined capital addition annually (minimum amount la , if your directors all $$$$$$$ a lot , then this amount also exponential la)

4) No money can be taken out till year 51 ah , when the company can be disbanded lol , each shareholder should get back around $263,800-ish

5) If any shareholder R.I.P or wants to sell away their stake and take back their capital , they can do so , but have to sell to their direct descendants first , if no direct descendants, then they have to offer their shares to other shareholders first , OR if no direct descendants , and with 51% shareholders approval , liquidate that particular shareholder's shares , and return him or her with the capital put in so far together with dividend payouts, excluding the 13 mth contributions.

The aim of such a company is to provide a small safety net for my future descendants (if any) and if done properly , i guess we might end up as substantial shareholders of some listed companies LOL.

I told my mum this , and i'm gonna say it here also. This company is not for us , but for future generations when we all R.I.P liao , so that they won't eat grass.... eat ownself. It's a manageable and realistic amount to contribute especially if put on a monthly basis , provided all relatives (shareholders) can get along and the Managing Director(elected on a yearly basis via voting) does his or her job well , putting the company's best interests first.

I know some of you , if not most will say doing business with family is the hardest as conflicts if not resolved properly will lead to jialat consequences in future , but i always believed in one thing , that as a family , you will want the best for each other.

Oh ya , audio for y'all to listen to while figuring out the table.

Cheers

Ah Boy (Ken)

Image from google, vid from youtube.

I got this crazy (honestly .... if i find it a bit "siao" it should be quite siao la) idea that i've delayed over a year or two. Recent events such as my mum falling ill and the recent passing of my 大舅 (Mum's eldest bro) have helped cement the notion of going through with the idea.

THE IDEA in context? A family owned company which buys shares in listed companies with no or low debt and use the dividends to be reinvested together with additional capital contribution on a yearly basis.

I've attached a table below for viewing. Assuming a yield of 5% P.A. from dividends , excluding capital appreciation , aga aga results are as shown below.

FYI , my extended family is big so can do it on such a scale if not each shareholder contribution has to be larger to obtain such results.

Disclaimer(s):

1) Chart too small don't blame me , zoom in , zoom zoom. Paiseh la , i IT. noob (I provided two snips which should help in understanding the table.)

2) This is based on $100 contribution per shareholder for 13Months! (Why 13 mths? Like working ma , need to have bonus! Kidding la , the 13th month contribution is for company expenses like admin fees ,brokerage fees, acra fees etc etc.)

3) This company has 11 directors so $100 x 12mths = $1200 x11 = $13,200 combined capital addition annually (minimum amount la , if your directors all $$$$$$$ a lot , then this amount also exponential la)

4) No money can be taken out till year 51 ah , when the company can be disbanded lol , each shareholder should get back around $263,800-ish

5) If any shareholder R.I.P or wants to sell away their stake and take back their capital , they can do so , but have to sell to their direct descendants first , if no direct descendants, then they have to offer their shares to other shareholders first , OR if no direct descendants , and with 51% shareholders approval , liquidate that particular shareholder's shares , and return him or her with the capital put in so far together with dividend payouts, excluding the 13 mth contributions.

The aim of such a company is to provide a small safety net for my future descendants (if any) and if done properly , i guess we might end up as substantial shareholders of some listed companies LOL.

I told my mum this , and i'm gonna say it here also. This company is not for us , but for future generations when we all R.I.P liao , so that they won't eat grass.... eat ownself. It's a manageable and realistic amount to contribute especially if put on a monthly basis , provided all relatives (shareholders) can get along and the Managing Director(elected on a yearly basis via voting) does his or her job well , putting the company's best interests first.

I know some of you , if not most will say doing business with family is the hardest as conflicts if not resolved properly will lead to jialat consequences in future , but i always believed in one thing , that as a family , you will want the best for each other.

Oh ya , audio for y'all to listen to while figuring out the table.

Cheers

Ah Boy (Ken)

Image from google, vid from youtube.

That is foundation how can last for decades after decades on contribution by their founders. You can be Founder of your family foundation. :-)

ReplyDeleteUncle CW8888 ???? Simi how can last for decades after decades?? i catch no ball lol

Delete

ReplyDeleteCreatewealth8888April 12, 2016 at 8:02 AM

That is how foundation can last for decades after decades on initial contribution by their founders. You can be Founder of your family foundation. :-)

TIO LIAO!! OIC , that is what u meant :) :)

Deletefounder mai la , founders will be my mum and her family members :) I just kopi boy nia

DeleteHi Ken,

ReplyDeleteWow! Your idea seems like a mini family office. However, the risk is that it only takes one reckless and greedy descendant to squander the accumulated wealth away. Unless the money is placed in a trust and governed by strict rules.

Yo! Hoseh bo? Ya , sorta like that but if any of my relatives do that after 50 years or more..... i will come back from the grave to haunt them la!

DeleteI actually considered labuan trust or other forms of investment vehicles..... but too costly... usually suited for millionaires , which .... unfortunately my extended family lack of lol :)

Sounds like you're setting up a Fund Management Company. Need to be licensed dah.

ReplyDeletehmmm... not a fund mgmt company la , the co will also manage a small impex business as well so main biz will be general impex , but co can use funds to be placed into list co shares.

Delete